As financial markets adapt to a rapidly evolving economic landscape, the interplay between Bitcoin and traditional commodities like crude oil and gold offers a fascinating perspective on value, performance, and investor sentiment. While commodities like oil and gold have seen price spikes recently, their valuation in Bitcoin terms has declined, showcasing Bitcoin’s growing role as a global financial benchmark.

Commodities: Traditional Safe Haven Assets

Gold and crude oil have long been regarded as pillars of traditional finance. Gold is often seen as a safe-haven asset, prized for its ability to preserve value during times of economic uncertainty. Meanwhile, crude oil remains a cornerstone of industrial economies, its price often reflecting global demand and geopolitical dynamics.

Recent months have seen gold’s price rally in USD terms, driven by inflation concerns and geopolitical tensions. Similarly, crude oil has experienced significant price increases due to production cuts by major exporters and rising global demand. These trends have made headlines, suggesting a renewed faith in the value of these traditional commodities.

Bitcoin: The Emerging Digital Benchmark

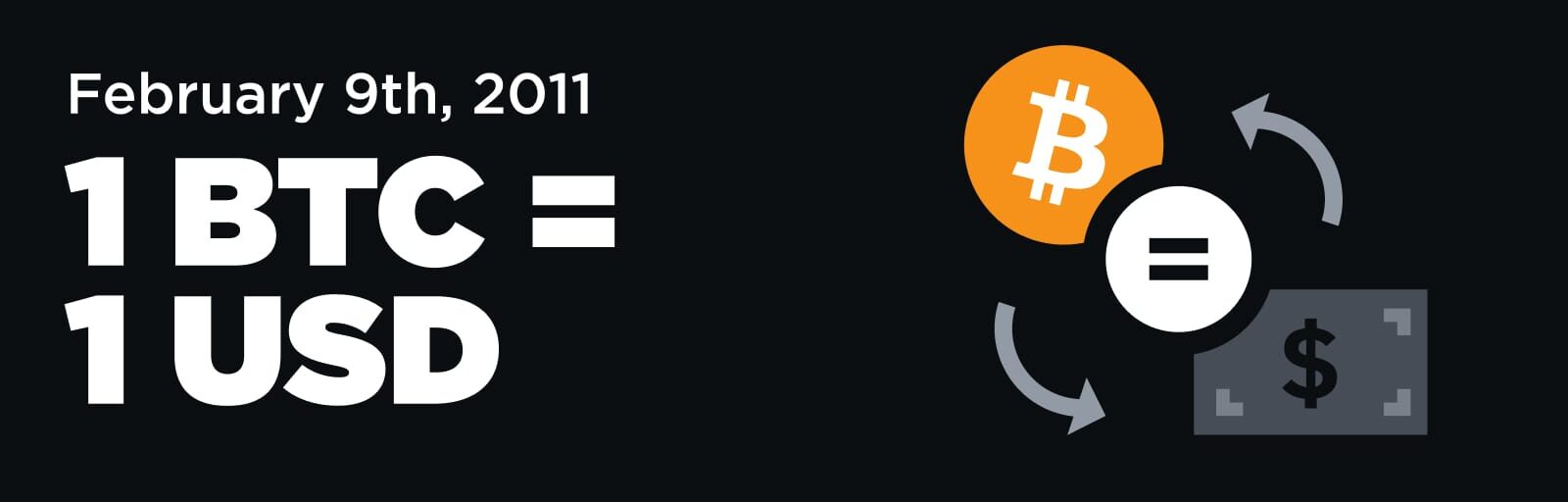

Bitcoin, often dubbed “digital gold,” offers a new paradigm in asset valuation. Unlike gold or crude oil, Bitcoin is decentralized, finite in supply, and not tied to any physical commodity. Its value is largely driven by market demand, adoption rates, and macroeconomic factors like currency devaluation and monetary policy.

In recent years, Bitcoin’s adoption has grown significantly among institutional investors, governments, and retail traders. Its performance often acts as a barometer for broader economic sentiment, particularly among those skeptical of fiat currency systems.

Commodities in Bitcoin Terms: A Declining Trend

Despite the price increases of crude oil and gold in USD terms, their valuation in Bitcoin has declined. This phenomenon is due to Bitcoin’s outperformance during the same period. As Bitcoin continues to gain traction as a store of value and an investment vehicle, its ability to outpace traditional assets highlights its resilience and appeal.

For example:

- Gold: While gold may have risen by 10% in USD terms over a given period, its value relative to Bitcoin could decline by 15% if Bitcoin’s price rises by a larger margin.

- Crude Oil: Similar trends are observed with oil, where price gains in traditional currency terms are overshadowed by Bitcoin’s more significant upward movement.

This relative decline underscores a shift in how investors perceive value. Bitcoin’s ability to serve as a hedge against inflation and a tool for wealth preservation increasingly competes with traditional commodities.

Implications for Investors

The divergence between Bitcoin and commodities in valuation terms raises important questions for investors:

- Diversification: While commodities like gold and oil remain essential components of a diversified portfolio, Bitcoin’s inclusion provides an alternative hedge against economic uncertainties.

- Long-Term Trends: Bitcoin’s limited supply and decentralized nature position it uniquely in the face of ongoing monetary policy shifts and inflationary pressures.

- Market Sentiment: The decline in commodities’ value relative to Bitcoin reflects shifting market sentiment toward digital assets as a cornerstone of future finance.

Conclusion

As the financial ecosystem continues to evolve, the dynamics between Bitcoin and traditional commodities offer valuable insights into the changing nature of value and investment strategy. While crude oil and gold remain important assets, their relative decline in Bitcoin terms signals a growing shift toward digital asset dominance. For investors, understanding these trends is essential in navigating a rapidly transforming market landscape.

This article does not provide investment advice. All investments involve risk, so readers should do their own research before deciding.